Oh no.

Good?

So he moved his company out of the UK to avoid tax.

Refusing to cover his share of building the infer structure his and other companies depend on. Also making it harder for non-shitty companies to compete.

And now wonders why the UK is forced to reevaluate how taxing shitty idiots like this needs to work,

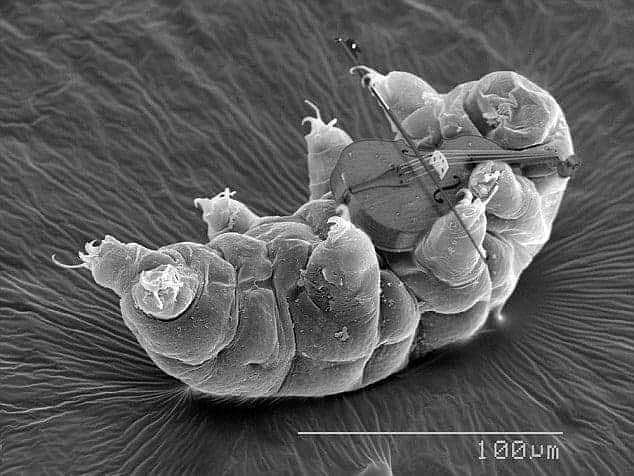

We can go smaller.

Prefect

What makes them “British expats” and not regular old “immigrants”? Oh their wealth? Maybe their skin colour

immigrants actually help the economy and try to integrate. expats expect wherever they go to cater to them, and extract wealth for their own benefit

Yeah but white people in a foreign country gottl to cope

I am a nomad Capitalist 🤡

Direction? To Britain they’re expats, to Spain they’re immigrants? (or whatever the Spanish word for Immigrants is, I suppose.)

People leaving are emigrants. People entering are immigrants. Expat is just a word to whitewash the immigrant label. I say this as an american emigrant who knows “expats” in my new home country.

Expat is a corporate term for employees working temporary on companies from one country working on another.

I don’t how being an ex-patriot is a good thing for those of a nationalistic bent.

I can’t tell if you’re joking but it’s an abbreviation of patriate not patriot > same root but patriot implies liking or serving the country and patriate - from patria - just means “from that country”

We can always pretend that isn’t true so it isn’t such a neutral term.

To the UK they are emigrants.

Expat is a casual term referring to someone whose employer sent them overseas on a posting. Diplomats are the most obvious example, but companies will use the same employment structure.

Different jurisdictions have different official terminology for this type of migrant worker, but their legal status in the host country is typically different to that of other categories of migrant worker in the same country, they are usually paid & taxed in their home country, and employed under the regulations of their home country (though in some instances, a host country may extend protections or impose obligations over them).

The confusion arises because when the UK had an Empire, huge numbers were sent abroad to run it, whether for companies like the East India Company, or as civil servants or on military postings, and so the British now think of “people who live abroad” as “expats” because that’s the word the older generations always heard, and then continued to use long after this ceased to be the predominant vehicle for of British to be living outside the UK.

The word is absolutely couched in a colonial past, but those using the term to describe other types of British people overseas are not generally doing so out of some sense of white supremacy or British exceptionalism, but plain old lack of awareness.

Big up yourself for a solid, informative answer!

Yeah, while I think expat is a bit of a silly word, it’s a lot more precise. Just saying “immigrant” could mean an immigrant living here or an immigrant to another country from here.

It’s also way more concise and therefore headline-friendly: “Expats say XYZ” vs “British immigrants in ABC say XYZ” or “Overseas Brits say XYZ” (and that one introduces confusion about whether they are overseas as in on holiday/temporary work or overseas as in living there).

It’s a term that rustles my jimmies. You’re an expat if you’re moving to a country for work, you’re an immigrant if you are moving to live.

That seems to imply immigrants move to countries to laze around and do nothing. You’re not allowed to stay in the country anyway if you don’t have a job or have some kind of visa that doesn’t require you to work. “Expats” are immigrants like the rest of them.

Yeah I think you’re reading too much into that statement.

Spitting that 🔥

Get wrecked.

It’s time we started standing up to the threats of big business and their little sob stories. And their cynical attempts at claiming harm on behalf of working people.

Yeah like honestly, let them go broke. If they were doing anything useful, a small local business will probably pop up to fill the gap. And if they aren’t, then it doesn’t matter. And most of these big companies are dodging taxes anyway so it’s not like we lose out there.

This exactly. If a company is not paying the expected taxes. Goodbye, let a smaller company compete, that has not learned to be a shithead and provide unfair competition through it tax avoidance.

Oh gosh, I am so sorry, nevermind.

I thought these idiots got sent back after Brexit, but I guess they weasled out of it.

As someone working in a different EU country having business with Spain, I have to wonder why the Spanish tax authorities do everything that they can to make it impossible to pay taxes. It’s insanely bureaucratic.

If your want to pay them, you need to request (in Spanish) to make a payment, classify exactly what you’re paying (using internal Spanish Tax Authority codes, which are not present in the letter) just to get a reference code that will identify your payment, and only after that are you given the information to actually make a euro zone payment, which is then set for payment at a specific date or otherwise it will fail.

We owed them 0.57€ for interest on a periodical indiscrepancy and they still sent a stamped letter to let us know. Just the cost for them and us to do so easily runs into hundreds of euros for each part…

Tax authorities in other countries either send out the necessary information to actually pay the claim or have a fixed payment account based on company number, so you can always pay and have it allocated correctly. Just give me the IBAN and a reference?!

I can’t even be bothered to start thinking about the various ways that this system can be fucked over, but here they are only accepting that method.

TBH you need a Spanish Gestor (accountant/attorney) on retainer to handle this for you. The .57¢ will cost you 50€ to process though…but that is also tax deductible.

Oh, and make sure It’s a reputable one…so many stories of them taking the money for years of foreigners and not paying a cent and skipping out of town. We got lucky and after asking our neighbors, ours is the son of a judge and the family has been part of the community for generations.

a capital gains rise would hit us hard

Promise?

Countries like Portugal, Spain, Greece, Cyprus, the Netherlands, and Malta

All mentioned in the article as places you can go to avoid paying taxes. I wonder what they all have in common 🤔😂.

Low taxes

Soooo… what’s for dinner today?